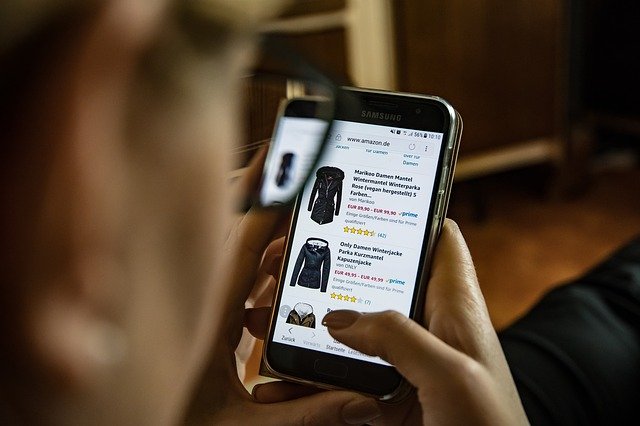

Reading, home of festivals, academia and all things IT can now lay claim as another centre of excellence – shopping.

Analysis of 60 UK locations placed it in top spot among places shoppers are most likely to engage online.

The fact that it’s home to some of the UK’s fastest broadband speeds and one of the lowest numbers of postal and courier complaints last year meant is pipped London to the title of online shopping’s premier hotspot.

The town also has the third highest average salary range – £36,500 – and, all in all, ranked in the top 10 for five out of the six factors applied by researchers.

Payments provider, Mollie, spearheaded the analysis in which each location was given a rank based on the number of business closures, high street strength, offline spending, postage and courier complaints, broadband speed and average salary.

Also making it into the top five is Glasgow – which came third, despite having the second least popular high street of all the locations studied, followed by Slough and Milton Keynes.

At the bottom of the table were Sunderland, Barnsley and Plymouth, where residents are more likely to head to a physical shop. According to the data, Sunderland has the fewest business closures, but second to lowest average salary at £24,961.

Even as restrictions are eased, retail footfall will not return to pre-pandemic levels any time soon

Mollie’s UK country manager, Josh Guthrie, said: “With Covid-19 accelerating the shift towards online shopping, businesses have never had a better opportunity to grow. At the same time, competition for businesses to attract and engage with consumers is more fierce than ever.

“We wanted to gather this data not only to highlight the areas of the UK most likely to shop digitally, but to give businesses a steer as to where they could be focusing their marketing efforts.”

Industry statistics released last week revealed total UK footfall decreased by 17.1 per cent in January, with a 1.5 percentage point improvement on December.

British Retail Consortium CEO Helen Dickinson, said: “It was a slow start to 2022, with only minor improvements to UK footfall despite a significant decline in Covid cases. Indeed, it was quality over quantity in January; less people visited retail parks and shopping centres, but those who did went to more stores at each location.

“Even as restrictions are eased, retail footfall will not return to pre-pandemic levels any time soon. This poses a challenge to many town and city centre retailers who continue to be impacted by lower commuter numbers. However, opportunities retain; innovative retailers are reacting to new consumer behaviours by investing in physical and digital offerings in order to draw in new customers.”

Official statistics show that internet sales currently count for 27.7 per cent of total retail sales.