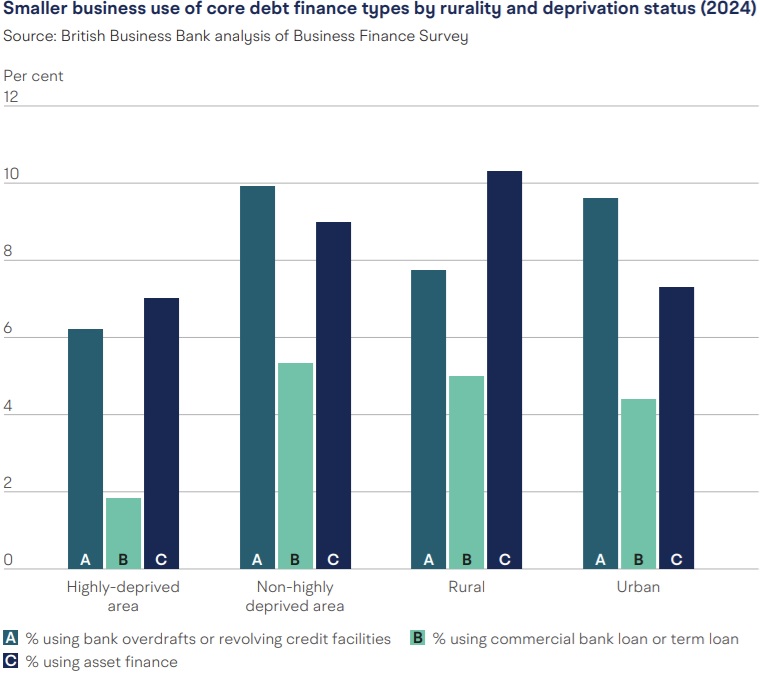

Business owners in deprived urban areas are less likely to be able to access funding than those in wealthier parts of the UK.

According to research by the British Business Bank, the use of credit cards, overdrafts and loans by founders in highly deprived areas is “significantly less” than in non-highly deprived locations.

The Bank’s annual report into the use of external finance said small businesses in

deprived areas were more inclined to seek finance, but were more likely to be discouraged from doing so.

“This evidence shows that where your business is located has an influence on your ability to access finance, not just at a regional level, but also at a subregional level”, the British Business Bank concluded.

It added: “This underscores the importance of recognising that localised gaps can exist even in seemingly well-developed regional debt markets, and that public policy interventions such as those taken forward by the Bank should continue to take gaps that do not follow a stark regional divide into account.”

Use of external finance by businesses

The British Business Bank’s report found that overall use of external finance was “stable” in 2024, following “a sharp uptick” in 2023. It fell by one percentage point to 45%.

The North West and East of England saw the strongest growth, with five and three percentage point increases, respectivelly. Other areas saw declines, including the East Midlands (-9 percentage points), the North East (-8) and Wales (-7).

The report said small businesses’ openness to use external finance increased by five percentage points to 38% UK-wide, with the biggest rise in the West Midlands, which saw a 20 percentage point rise.

But businesses are still cautious, with 19% of those who were open to considering finance to grow thinking it would be difficult to secure it.

Equity investment across the UK fell by 2.5% to £10.8 billion in 2024, with deal volumes down 15.1%, which is close to 2018 levels.

Outside London, the gap is narrowing, the British Business Bank said. The number of unique investors per 100 high-growth enterprises rose from three in 2023 to five in 2025, which the report said is the first time since 2017 that growth in venture capital investor presence outside London has outpaced the capital.