The Invest in Women Taskforce, which was set up in 2024 to boost the amount of funding going to female entrepreneurs, has raised £635 million.

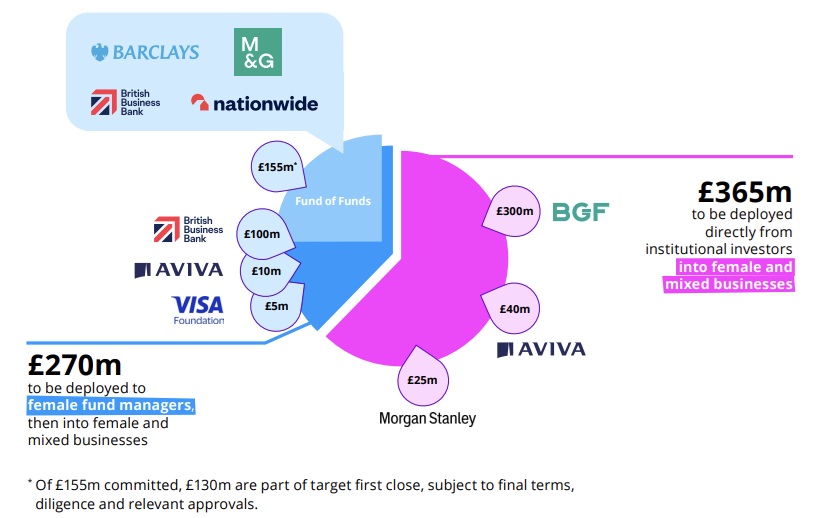

It has also been announced that Nationwide and the British Business Bank have joined as anchor investors, alongside existing institutional supporters Barclays and M&G, for the £130m ‘Women backing Women Fund of Funds’ which is expected to begin investing into female-led funds in 2026.

The taskforce said the fund, managed by Bootstrap4F, is thought to be the largest dedicated fund of funds in the world and the first female-led initiative of its kind.

The British Business Bank has committed £30 million and Nationwide is providing £25 million for the scheme

Subject to final terms, relevant approvals and signing, £270 million of the funding will be provided to female fund managers to invest in female and mixed gender businesses, while £365 million will be deployed directly from insitutional investors into female and mixed businesses.

The Invest in Women Taskforce was established by the Department for Business and Trade to tackle the big funding gap between male and female entrepreneurs.

Women business owners receive less than 2% of all equity investment, a figure that’s barely changed in the last decade. The taskforce’s new annual report shows just 1.3% of equity funding has gone to female-led businesses so far in 2025.

The Rose Review of female entrepreneurship, led by former Natwest Group CEO Alison Rose, said £250 billion could be added to the UK economy if women were to start and scale their business at the same rate as men.

Chancellor Rachel Reeves said:

“Growth is this government’s number one mission, and I am backing female-powered business not only because it’s critical for our economy but because it is the right thing to do.

“As the first female chancellor in the UK I have committed to improving economic outcomes for women, from lifting the two child benefit cap to breaking down barriers and opening pathways for women to start, scale, and invest in businesses across Britain.”

Hannah Bernard, co-chair of the Invest in Women Taskforce, said:

“Female-led businesses deliver 35% higher returns than male-led businesses, and play an essential role in supporting UK growth, so this is not only the right thing to do, but a commercial imperative. We need to quickly address the gender balance of both investment committees and their capital deployment, and continue to highlight the positive economic impact that women deliver.”

Debbie Wosskow, multi-exit entrepreneur and co-chair of the Invest in Women Taskforce, said:

“Reaching first close will be a huge milestone and we’re incredibly proud of the progress made so far, with more than £70 million deployed by partner programmes this year.

“We have worked tirelessly to build the funding pool over the past year, the largest of its kind in the world. But c.80% of UK venture capital still goes to all-male teams. Studies show that diverse teams deliver stronger returns – so what are we waiting for?”

Introducing a Female Enterprise Investment Scheme was one of 26 recommendations in a report by the Women and Equalities Committee earlier this year.

Chair Sarah Owen MP said the committee received “concerning evidence that female entrepreneurs face significant disadvantages in accessing finance, networks and support due to systemic bias, a lack of diversity among investment decision-makers and entrenched cultural norms”.