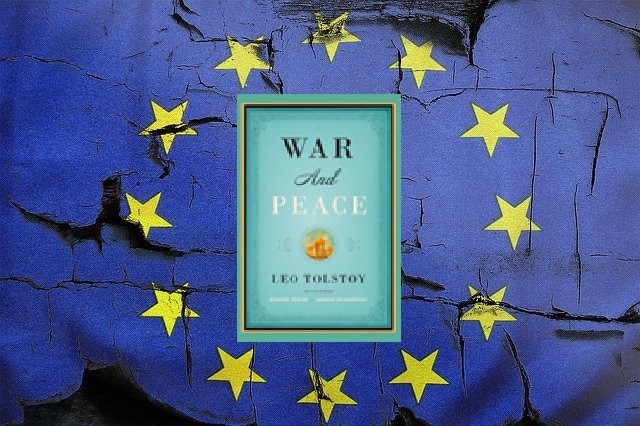

As businesses brace themselves for another couple of days of crunch Brexit talks, one national law firm has likened the task facing company bosses as having to read the equivalent of Tolstoy’s epic novel to understand the basic riules.

Business lawyers at Irwin Mitchell examined the recent guidance compiled for different sectors of the economy and revealed the huge amount of information that needs to be digested.

For consumer goods businesses, for example, there are currently 33 pages of guidance and information in 13 sections, adding up to 581,704 words. It’s estimated that this would take the average person almost 40 hours to read – the equivalent of a full working week.

The guidance, which covers areas including importing and exporting, selling goods, workforce, data and intellectual property, contains 20,000 words more than War and Peace, the first four Harry Potter Books, or the entire Lord of the Rings and the Hobbit series.

there’ll undoubtedly be more guidance and much of it will make a lot of what they are currently reading, redundant

The lawyers say the reading requirements are similar for other sectors and expressed concern that there is a lot more to come once the situation about whether there’ll be a deal or not becomes clearer.

Vicky Brackett, CEO of their Business Legal Services division, said: “As with many things to do with Brexit, the Government’s strategy on guidance seems to be evolving.

“Although it’s positive that the Government wants to keep businesses and individuals informed and that it has recently consolidated its sector-based guidance, it must recognise the huge pressure businesses are under and the amount of information and rules they’re expected to get to grips with in a short period of time.

“The sheer size of the task is incredibly daunting for many, particularly at a time when organisations are already dealing with the significant challenges of the global Covid-19 pandemic.

“Businesses are desperate for certainty but as the outcome of the current negotiations hopefully become clearer, there’ll undoubtedly be more guidance and much of it will make a lot of what they are currently reading, redundant.”

The impact on the UK’s thriving fintech scene may be less visible, but it is no less costly and just as unnecessary

“The government needs to do more to help businesses, starting with making guidance not only more digestible, but timely and easier to access.”

Writers and critics have long regargaded the 1300-page epic as complex, combining as it does narative and philosophy, quite apart from its length. Even the appreciation site Tolstoy Therapy as an almighty Russian tome, and gives tips on how to read it.

The effects of Brexit will be painful for some regardless of whether a deal is struck or not. This being said, those who have fully prepared for the worst outcome will be those who fare best. Meanwhile, those who spent the last four years denying the reality of Brexit will undoubtedly suffer the consequences of their inaction in 2021.

More worryingly, the business software provider Soldo has researched how well prepared companies are for a full withdrawal and found that only 52 per cent of UK businesses felt they were. In fact, while 66% of companies with 501-2000 employs said they were, that number dropped to 51 per cent amoing those with 51–500.

Soldo President Mariano Dima, said: “Perhaps understandably, much of the recent media focus on Brexit has been on stockpiling, shortages and the price of imported goods increasing overnight, pushing inflation to levels more usually associated struggling economies in less developed countries.

“The impact on the UK’s thriving fintech scene may be less visible, but it is no less costly and just as unnecessary. Here at Soldo, we started planning for Brexit in 2017. We’ve spent serious sums preparing, most of it in the EU.

“With the guidance of the Irish Development Agency we established a company in Ireland, created a parallel financial services division in Ireland, obtained an Irish e-money licence and have appointed a talented team to run the operation in Dublin.”

.