By Andrew Woolnough, founder and director of Un:fade Consulting

Traditional employee gifts and payroll bonuses are costing small businesses more than they realise and failing to make a real impact on morale. By embracing the HMRC trivial benefits exemption, SMEs can turn simple gestures of appreciation into a cost-efficient recognition strategy.

Think back to the last “gift” you received from work. Was it thoughtful? Useful? Or did it end up at the back of a cupboard?

And yet, the power of a great gift is undeniable:

A survey by Nectar found 83.6% of employees say recognition affects their motivation to succeed at work and a Canva survey found 87% of respondents said feeling appreciated positively impacts their motivation. It’s rarely about a lack of care. Most small-business owners genuinely want to recognise their teams, but the traditional routes simply don’t work anymore. Bonuses get swallowed by tax; hampers get forgotten; the moment passes.

At a time when every pound of reward spend matters, SMEs need a smarter, simpler way to say thank you.

The hidden cost of payroll “rewards”

Adding a small bonus to payroll sounds convenient, but it’s far from efficient.

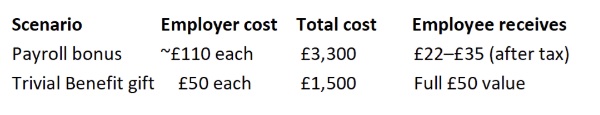

A £50 “thank-you” payment can end up costing the business around £110 once employer National Insurance and payroll overheads are included. After deductions, employees often take home just £22–£35.

That’s double the spend for half the impact a tough equation for any small enterprise.

Under HMRC’s trivial benefits exemption, businesses can give employees non-cash gifts worth £50 or less completely free of tax and National Insurance as long as:

- The benefit costs £50 or less (including VAT)

- It’s not performance-related

- It’s not contractually owed

No PAYE, no reporting, no hidden admin. Just genuine appreciation that costs what it says on the tin.

Bringing this to life and looking at the numbers in practice for an organisation with 30 employees who wishes to give everyone a £50 Christmas reward.

However, once-a-year gifts don’t build culture. Recognition does. Smaller, more frequent gestures £25 for a great customer review, £40 for a birthday, £50 for teamwork create regular touchpoints of appreciation. Over time, those moments form a rhythm of recognition that strengthens connection and engagement. It’s not about the size of the gift; it’s about the sincerity and consistency behind it.

In addition, choice matters. The most common complaint about company gifts? They feel impersonal. Give employees choice is key. There are reward platforms on the market where, SMEs can gift points, digital vouchers or prepaid balances so staff can choose what suits them whether that’s dinner out, new tech, or a family day trip. The same £50 budget suddenly feels personal, flexible, and valued.

Like many articles about reward and employee benefits that go before this, flexibility is the new currency. Today’s employees value flexibility across their financial lives early access to pay, wellbeing stipends, cashback on everyday spending. For SMEs, that means viewing gifting and financial wellbeing as part of the same strategy: meaningful, everyday support that shows you understand what people need most.

So why isn’t gifting and trivial benefits not more widespread in the SME space? Many organisations say that cost is a barrier in accessing platforms (Hint: Not true anymore) in addition to the concern about “Too much admin.”, approvals, tracking, receipts, compliance all for a £30 gesture. In today’s market there are SME platforms that remove that friction, managing everything from approvals to HMRC compliance so appreciation can happen instantly and effortlessly.

For growing businesses, this is a rare win-win by adopting the trivial benefits exemption, SMEs can reward employees more meaningfully, cut recognition costs by up to 50 per cent, stay fully compliant with HMRC and build a stronger, more appreciative culture

This isn’t about mugs or hampers. It’s about creating a workplace where appreciation feels authentic and financially makes sense. For UK SMEs, the trivial benefits rule isn’t an obscure tax loophole it’s a practical, proven way to give more, spend less, and make gratitude part of everyday culture. At the end of the day saying “thank you” should never cost twice as much as it needs to.